Tracking Costs and Fees: Where Money Leaks from Your Portfolio

Costs in investment funds are often fragmented and invisible, significantly affecting real net performance.

For partners and decision-makers in private equity and venture capital funds, the success depends not only on deal selection, but above all on full cost control. In practice, small fees and inefficient processes can consume a significant portion of investment returns, while the lack of a complete cost picture makes informed investment and strategic decisions difficult.

Where Value Leakage Occurs in Investment Funds

In many funds, costs are known but not visible in their entirety. They exist in separate reports, systems, and spreadsheets, growing along with the scale of operations. The lack of a single cost view makes informed investment and strategic decision-making difficult. Below are five areas where value loss most often occurs, along with solutions used in mature organizations.

Note: This article is based on our experience with clients from the investment sector, complemented by data from the ESMA Report on Total Costs of Investing in UCITS and AIFs.

Fragmented Cost Structure – Portfolio Costs No One Sees in Full

Challenge

Investment portfolio costs are scattered across multiple sources: transaction fees, FX, custody, fees at the portfolio company level, or investment vehicles. Partners see individual figures, but not the full cost picture. According to ESMA, distribution costs constitute nearly half of total costs for UCITS and 27% for AIFs; inducements play a central role in ongoing costs, highlighting the importance of full cost visibility.

Solution

Centralized monitoring of portfolio costs in a single analytical environment enables a dynamic view of costs over time and in the context of assets. Integrating data from different systems makes it possible to identify cost sources and spending structures.

Impact on the Business

Partners gain full cost transparency across the portfolio, can allocate capital more effectively, and make informed decisions about scaling or exiting investments, reducing value leakage.

Fee Leakage Over Time – Small Costs with a Big Impact on Results

Challenge

Small unit fees, when accumulated over time, can significantly reduce a fund’s net performance. ESMA shows that the total annual cost of investing EUR 10,000 ranges from EUR 50 for passive UCITS bonds to EUR 200 for active UCITS equity, and from EUR 144 to EUR 280 for AIFs depending on type. Such “silent leakages” are rarely analyzed trend-wise and usually become visible only in annual reports or audits.

Solution

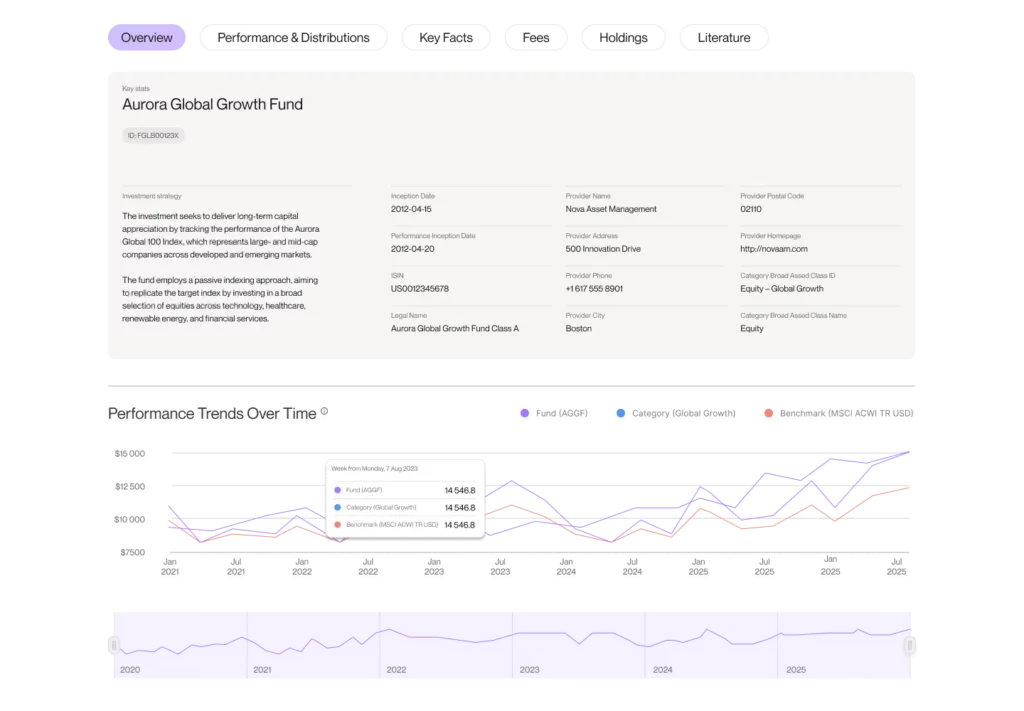

Monitoring costs over time and visualizing trends helps identify anomalies and process errors, and distinguish justified costs from inefficient ones.

Impact on the Business

The fund can react earlier, improving capital efficiency, stabilizing margins, and increasing result predictability.

Operational Cost Drag – Fund Costs Growing Faster Than AUM

Challenge

Operational costs (reporting, compliance, financial operations, analytical teams) often grow almost linearly with AUM when processes remain manual and fragmented. Partners do not know which processes generate the greatest burden.

Solution

Linking operational costs to fund processes and business areas, combined with centralized reporting, makes it possible to identify where automation and standardization deliver the greatest savings.

Impact on the Business

The fund can scale operations without a proportional increase in costs and operational risk, increasing strategic flexibility and resilience to market pressure.

Performance Without Costs – A Misleading Picture of Investment Results

Challenge

Analyzing investment performance without including costs can be misleading. ESMA indicates that PRIIPs maximum one-off fees do not reflect actual fees, confirming that gross return data alone does not show true effectiveness.

Solution

Integrating performance and cost data allows real-time analysis of net returns and evaluation of strategies through the lens of real economic effectiveness.

Impact on the Business

Investment decisions become more precise, capital allocation improves, reputational risk is reduced, and consistency of performance communication to LPs increases.

Transparency for LPs – Cost as an Element of Investor Trust

Challenge

The lack of a consistent view of fund costs can weaken LP trust and extend reporting processes.

Solution

Integrated cost and performance reporting enables presentation of the full picture of fund effectiveness, simplifies communication, and reduces the need for explanations.

Impact on the Business

The fund builds a reputation as a transparent and operationally mature organization, strengthens investor relationships, and increases credibility in fundraising processes.

Summary – Cost Control as a Competitive Advantage

Costs are a strategic factor affecting net performance and fund scalability. Conscious cost management allows the CFO to control expenses and forecast cash flow, the CIO to optimize capital allocation, the CEO/Managing Partner to better communicate fund effectiveness to investors, and the Head of Investments to make faster investment decisions and improve team efficiency, minimizing losses resulting from operational costs.

Find out how to effectively monitor costs and improve net results using dataviz tools for the investment sector.