Tulip Mania – The Dataviz Behind the Dutch Flower Bubble

There’s been many economic bubbles over the years but there’s never been such a beautiful disaster as when the Dutch tulip bubble burst. Buckle up your clogs and let’s dive in!

Welcome to the next episode of our historical data visualization series. Today we’ll be talking about a weird and wonderful incident called Tulip Mania which took place in the Netherlands in the 17th century. So take off your clogs, grab a cup of special tea, and tilt into this incredible windmill of a story…

Once upon a time a long time ago a couple of traders from the Ottoman empire decided to bring tulips to Europe. The flowers quickly became popular in the Republic of the Seven United Netherlands. Unlike anything else available in Europe at the time, these rare flowers captivated the middle class and aristocracy with their remarkable appearance and vibrant colors.

Unfortunately, all of the species of tulip were not accustomed to the European climate, so the flowers died quickly. If things had remained that way then that would have been the end of the story and… countless people may not have lost their houses, fortunes and families could have been saved and, more importantly, I wouldn’t have written this blog post. I would even go as far as to say that…

Everything would have been fine if it hadn’t been for… Charles de L’Écluse

Indeed, it seems this renowned doctor and botanist is to be blamed for the flower fiasco as he is the one who found a way to grow and cultivate tulips in Europe. He developed varieties of the flower which were able to endure colder temperatures and survive the European climate. And once the tulips were climate resistant the real trouble began….

At the beginning, no one could have expected that the price of a single tulip bulb could go so high. And so many Europeans slowly started becoming obsessed with the unique look of the flowers. This coupled with the fact that these beautiful bulbs weren’t cheap to begin with, set the groundwork for the blossoming of an unprecedented financial bubble.

Would the story have been any different if the Dutch had studied up on Financial bubbles from the past? If they could have visualized them using charts, would it have prevented the subsequent disaster?

“Those Who Do Not Learn History Are Doomed To Repeat It.“

George Santayana

But let’s be honest, such financial bubbles have happened ever since humans first began trading in small clans. Looking back at history can help us understand why something happened and what we can learn from it. If we’re investigating an event that has numbers and raw data, the best way to understand it would be to visualize it and analyze it. So with this in mind, let’s take a look at how Tulip Mania i.e. the twenty year price spike of tulip bulbs would have appeared in chart form.

When one tulip was worth 10 silver cups… or 215 fatty pigs. Talk about a blooming economy!

In 1593 Charles de L’Écluse developed the tulip variety which was resistant to colder temperatures and so the era of tulips in the Netherlands began. In the beginning, the price of the flowers was pretty normal but over time it started to grow…

By 1623 the price for a single, average tulip grew to 1,000 guilders but for one Viceroy (the rarest species of tulip) the price reached 2,400 guilders, when 4 tons of wheat cost 448 guilders, 8 fatted pigs were 240 guilders and a silver cup was 60 guilders. Already crazy, but from the chart you can see that around 10 years later the price for a single, average tulip was equal to 40 tons of wheat or 215 fatted pigs. That’s horrendous.

Of course, people noticed that the price was rising very quickly and they smelt an opportunity. If they bought some of the flowers now, they could sell them again in the future for a handsome profit. The result? Short selling.

Officials soon noticed and in 1610 the first edict was passed banning the short selling of tulips, a principle which was reaffirmed in 1621, 1630, and once more in 1636. While short sellers faced no legal consequences under these proclamations, forward contracts became unenforceable, allowing traders to back out of agreements in the case of any losses.

Bubbles Always Burst

The tulip bubble – where flowers bloomed and then… wilted (reproduction of Earl Thompson chart)

In the end the speculative bubble burst, leading to a sudden decline in tulip bulb prices. I want to highlight three key events that contributed to its ultimate downfall:

- Growing Doubts: People began to question the value of tulip bulbs, as they had reached exorbitant prices with no real utility.

- Panic Selling: Some tulip holders became alarmed by the falling prices and started selling their bulbs en masse, causing a rush to exit the market.

- Loss of Confidence: As more and more people became uncertain if their investments were safe, they began to sell off their tulips, the market in turn began to lose confidence and prices began to fall dramatically.

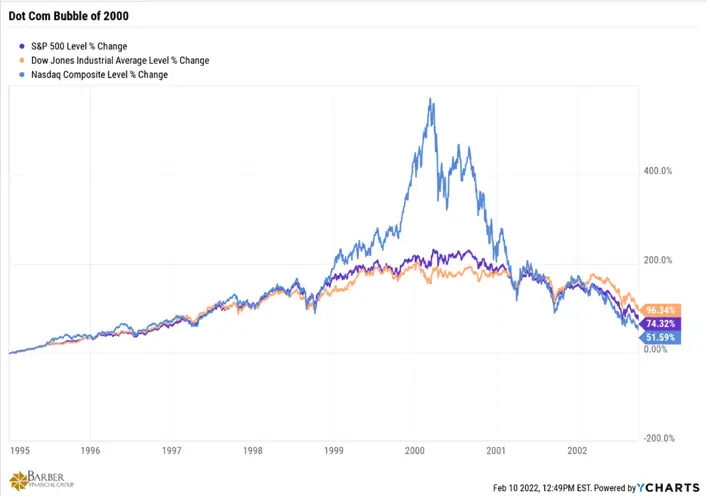

Tulip Mania perfectly illustrates how market euphoria can lead to a sudden and dramatic collapse in asset prices. A very similar thing happened in 2000 on the NASDAQ…

The Bursting of the Dot-Com Bubble

In the late ’90s, low interest rates fueled a rapid rise in dot-com start-ups. While some had solid plans, others lacked the requisite skills but still drew investors in with the novelty of the dot-com concept.

What Actually Led to the Bursting of the Dot Com Bubble?

Between 1990 and 1997, the percentage of households in the United States owning computers increased from 15% to 35%, as computers transformed from conveyors of luxury status to a daily necessity. Also, in 1997, the Taxpayer Relief Act was passed which lowered the top marginal capital gains tax in the US. The act also made people all the more eager to make speculative and risky investments.

Many believed that the Telecommunications Act of 1996 would result in an avalanche of new technologies which people could make a fast buck off of. Unfortunately, it didn’t quite turn out this way and many people lost their money.

Ultimately, the bursting of the Dot Com bubble led to many startups failing, but some succeeded in the early 21st century. Successful companies had a strong business plan and a clear niche. Afterwards, telecoms had excess capacity, which led to them reducing connectivity charges and making high-speed internet more affordable. Companies like Google and eBay developed successful models, altering advertising, sales, and customer relationships. Despite the bursting of the bubble, the internet continued to grow, driven by commerce, more online info, social networking, and mobile access.

Tulip Mania vs The Dot Com Bubble

I’m afraid that no such companies like Google or eBay emerged victorious after the Tulip Mania crisis in the 17th century. However one thing the Tulip Mania and Dot Com bubbles both had in common was the rapid increase of the price of Tulips/internet startup stock to the point the price became unsustainable and ultimately led to a crash.

In both of these cases, the financial bubble followed these five stages:

- Displacement: The bubble begins with a fundamental change creating investment opportunities, attracting capital to specific sectors.

- Boom: There is a rapid increase of the asset price as more investors join creating positive feedback loops and fostering optimism.

- Euphoria: Irrational exuberance sets in, detachment from fundamentals and widespread speculative behavior.

- Profit taking: Savvy investors start cashing out as they realize inflated valuations, triggering a slowdown in price increases.

- Burst: The bubble bursts leading to a rapid decline in asset prices, panic selling, economic contraction and financial distress.

Now that we’ve taken a look at the fundamentals for the creation of financial bubbles, let’s see if there have been any bubbles more recently or even happening right now…

The NFT Bubble

You’ve probably heard about NFTs before but you probably didn’t know that the first NFT was created over a decade ago. NFTs became insanely popular in 2021 and… how are they doing now? Are they still popular, are people buying NFTs?

How the NFT Bubble Began

The NFT (Non-Fungible Token) scene really took off in the months leading up to 2021, and it kept buzzing throughout that entire year. NFTs are unique digital assets that use blockchain technology to establish ownership and authenticity.

Key Factors Contributing to the NFT Hype:

- Digital Art & Collectibles: NFTs gained traction as a new way to buy, sell, and trade digital art and collectibles. Artists and creators saw an opportunity to monetize their digital work and buyers were attracted to the idea of owning unique, verifiable digital assets.

- Blockchain Technology: The underlying technology behind NFTs is blockchain, which provides a secure and transparent way to verify ownership and authenticity. Blockchain ensures that each NFT is one-of-a-kind and cannot be replicated, addressing the issue of digital ownership and provenance.

- Celebrity Endorsements & High-Profile Sales: The involvement of celebrities and well-known figures in the promotion of NFTs brought mainstream attention to the market. High-profile sales, such as the $69 million sale of an NFT artwork by the digital artist Beeple at Christie’s auction house, contributed to the perception of NFTs as valuable digital assets.

- Crypto Enthusiast Participation: The crypto community, already familiar with blockchain technology and digital assets, played a crucial role in driving the initial interest and adoption of NFTs. Crypto enthusiasts were early adopters of NFT platforms and actively participated in NFT marketplaces.

- Ease of Transactions: NFTs use blockchain technology to facilitate transactions, making it easier for buyers and sellers to transact without the need for intermediaries. This ease of use and the ability to transact in cryptocurrencies contributed to the appeal of NFTs.

- Unique Utility & Interactivity: Some NFTs are designed to have utility beyond static digital images. They can represent ownership of virtual real estate, in-game assets, concert tickets, or other interactive experiences, adding a layer of functionality that goes beyond traditional digital art.

In the first months of 2021 the popularity of NFTs started increasing slowly and after a dip picked up speed. Just take a look at the chart down below. Does it remind you of any other bubbles we’ve looked at today?

Perhaps people’s New Year’s resolutions this year were to make better investments?

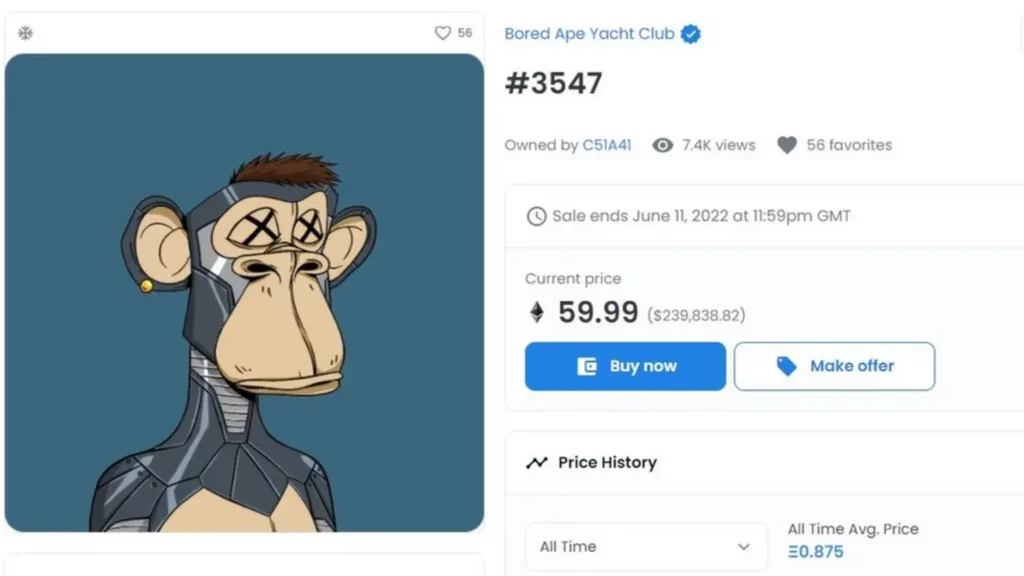

In January 2022, the NFT bubble finally burst, and the value of these digital treasures sharply started to decrease. The price of the most popular NFTs, Bored Apes, was around 400k dollars at its peak. Any idea about the price of a Perfunctory Primate today?

The Bursting of the NFT Bubble

It wasn’t the best spring of NFT investors’ lives (the chart is based on the conversation article).

As of September 2023 a Bored Ape NFT was worth less than $50k and as of July 2024 the price was down to about $35k. Still quite a lot, but quite a brutal drop for those who bought them at close to their peak thinking it was a good investment.

Once again we can see that the NFT financial bubble went through 5 crucial stages: displacement, boom, euphoria, profit taking and then finally bursting.

I’m sure that some of us thought that the price of those NFTs was definitely too high, and it was unreasonable to believe that it might have been a good investment.

And considering the key features from the various stages we talked about, it was possible to notice them in time. And by taking a look at a chart of NFT prices, we could easily observe that a financial bubble was being created… Are there any similar bubbles forming now? Well, the Collins Word of the Year for 2023 was AI…

From Tulip Mania to World War Pandemonia

Today we took a look at the field of data visualization from another point of view. We didn’t talk about a person involved in the development of dataviz but instead described some of the biggest financial bubbles from the past using clean and neat charts.

We’ll continue to take a break from looking at historic figures, and in the next Datavistory article we’ll be taking a look at…

The World Wars and how data visualization was used and abused in those conflicts. How many soldiers fought on each front? How could reading railway timetables in advance have saved thousands of lives? And finally, could we have used dataviz to predict the outbreak of World War I?

Slowly, step by step, we’re unleashing the true power of data visualizations and discovering some of the incredible areas where data fused with visuals not only seems to work like magic but has literally helped to shape human history.

That’s all for today. I hope you enjoyed our tulip bubble drill down in the third part of our Data Vistory series. Make sure to check out the other articles in this series and I’ll see you next time!