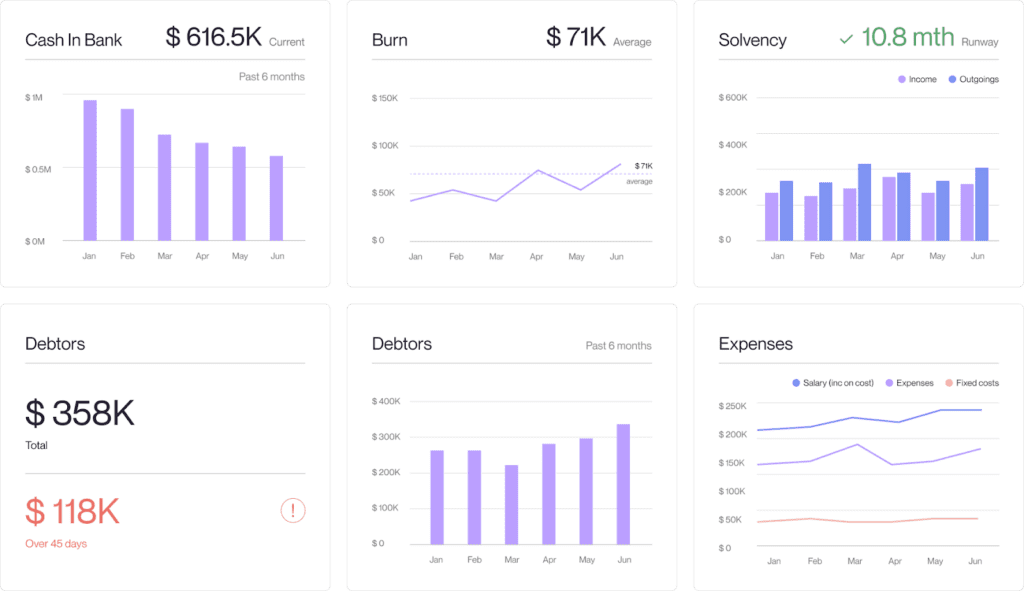

Cashflow Insights: Visualizing Incoming and Outgoing Capital

For CIOs, CFOs, and Managing Partners, cashflow is an operational indicator that directly affects the ability to execute investment strategy, manage risk, and maintain investor trust. Learn how investment organizations are turning fragmented data into a decision advantage.

In investment organizations, cashflow is not merely an accounting concept or a periodic reporting item. For CIOs, CFOs, and Managing Partners, it serves as an operational indicator of organizational health that directly affects the ability to execute investment strategy, manage risk, and maintain investor trust. Within private equity, venture capital, asset management, and financial institutions, cashflow is the element that connects investment decisions with their real financial consequences.

Paradoxically, despite the vast volumes of available data, many organizations still lack a coherent view of their cash movements. Data exists across banking systems, ERP platforms, portfolio company reports, and spreadsheets, yet it is rarely interpreted within a single decision-making context. As a result, leadership teams react to the past rather than actively managing the future.

The Evolution of the Operating Model: Why Traditional Data Approaches Fall Short

Moving from theory to practice in liquidity management exposes a significant operational gap. Although most investment organizations rely on advanced ERP systems and analytical spreadsheets, these data sources rarely communicate with one another. Managing cash movements becomes a labor-intensive process of assembling fragments from multiple, incompatible systems.

To understand why traditional approaches are no longer sufficient in a rapidly changing market environment, it is necessary to examine four key challenges faced by today’s CFOs and Managing Partners.

Note: This article is based on our experience with clients from the investment sector, complemented by data from the McKinsey Report: Global Private Markets Report 2025: Braced for Shifting Weather.

Fragmented Financial Data – Liquidity Seen Only in Part

Challenge

In mid-sized and large investment organizations, cash movements are naturally dispersed across multiple investment vehicles, bank accounts, jurisdictions, and currencies. Each operates on a different reporting cadence and often within a different system. CFOs see current balances, investment teams understand project-level funding needs, and executive teams receive aggregated data with a delay. What is missing is a single view that reflects the organization’s true liquidity position at any given moment.

In an environment where fundraising across private markets has fallen to its lowest level since 2016, and access to capital has become increasingly selective, the absence of a unified cashflow view materially increases both operational and decision-making risk.

Solution

Mature investment organizations bring structure to cashflow by centralizing data and applying a consistent analytical framework. Cash movements from multiple sources are integrated and presented within a single environment, preserving context such as which fund, portfolio company, currency, and time horizon. This layer does not replace accounting systems – it creates a decision layer that allows stakeholders to understand liquidity conditions quickly, without manual reconciliation.

Impact on the Business

The organization gains a single source of truth for all key stakeholders. Decisions related to investments, financing, and capital distributions are made faster and with lower operational risk. Dependence on manual reporting and informal knowledge held by individuals decreases, improving resilience as the organization scales.

From Historical Reporting to Liquidity Forecasting

Challenge

In many funds, cash flow is analyzed purely in retrospect. Reports explain what happened in prior periods but fail to answer how liquidity will evolve in the coming months. At the same time, market conditions in 2024 remained uneven, with subdued deal activity adding further uncertainty to planning. In the current shape of the market, reactive management is no longer sufficient. Without forecasting, leadership becomes aware of liquidity issues only once they have already materialized.

Solution

A modern approach treats historical data as a foundation for forward-looking forecasts and scenario analysis. Cash movements are analyzed over time, incorporating payment delays, seasonality, planned investments, and exits. Cashflow shifts from a static report into a simulation tool that enables management to assess the financial implications of different market and operational scenarios.

Impact on the Business

Leadership gains improved financial predictability and the ability to respond earlier to potential liquidity risks. As fundraising for traditional commingled vehicles declined by 24% year over year for the third consecutive year, the ability to manage liquidity proactively has become a core element of operational stability.

Investment Decisions Without a Liquidity Context

Challenge

In many organizations, investment decisions are driven primarily by metrics such as IRR, MOIC, or DPI, without fully accounting for their impact on near- and mid-term liquidity. Investment teams focus on returns, while cash consequences often emerge only during execution.

In an environment of constrained capital access and increasing pressure on distributions – where payouts to investors exceeded capital contributions for the first time since 2015 – this disconnect significantly raises the risk of liquidity stress.

Solution

Integrating investment data with cashflow analysis allows projects to be evaluated not only by potential returns, but also by their cash-in and cash-out profiles over time. This enables organizations to assess investments within the broader portfolio and available financial resources, making investment decisions more realistic and operationally executable.

Impact on the Business

Investment decision quality improves while the risk of misallocated capital decreases. Strategy becomes better aligned with operational capacity, resulting in greater financial stability and improved portfolio efficiency.

Financial Transparency as the Foundation of Investor Trust

Challenge

Today’s investors expect not only performance, but also clarity and consistency of information. Fragmented cashflow reporting, lengthy reporting cycles, and manual explanations undermine LP confidence and extend fundraising processes. The lack of a unified financial view also weakens internal communication between finance and investment teams.

Solution

A consistent, up-to-date cashflow view allows organizations to present investors with a complete and credible picture of their financial position. Financial data becomes part of a strategic narrative rather than a compliance obligation, reducing reporting effort and limiting ad hoc clarifications.

Impact on the Business

The organization builds a reputation for operational maturity and transparency. In a market characterized by prolonged fundraising cycles and capital declines spanning three consecutive years, predictability and clarity become tangible competitive advantages in LP relationships.

Conclusion – Liquidity as a Decision Advantage

In modern investment organizations, cash flow acts as an early warning system, linking financial data with strategic decision-making. Its importance grows in an environment of tighter capital, increasing market volatility, and heightened investor expectations for transparency and reliable reporting.

If you’re looking to turn fragmented cashflow data into a coherent, actionable view, we can help. Contact us to explore how our data visualization solutions apply to your case.