Dashboard Alerts – Catch Key Trading Signals Quickly

From noise to insight – learn how smart alerts help traders act fast, make better decisions, and keep users engaged on your platform.

Imagine a CPO in a fintech trading company. Their platform has thousands of active users, various types of traders – from beginner retail traders to institutional analysts – and hundreds of indicators and data streams updating in real time. Each user expects the platform not only to display data but also to help them make the right decisions.

Paradoxically, in a world full of data, more information often gets in the way. Traders feel overwhelmed, and the lack of proper context in alerts leads to ignoring critical signals. In such situations, the CPO’s role becomes strategic – it is not about adding another feature, but ensuring the product genuinely supports users and impacts business results.

This article outlines common challenges CPOs face regarding alerts on trading platforms, proposed solutions, and their real business impact, presented through practical product-focused stories.

Understanding the Role of Alerts in Trading Platforms

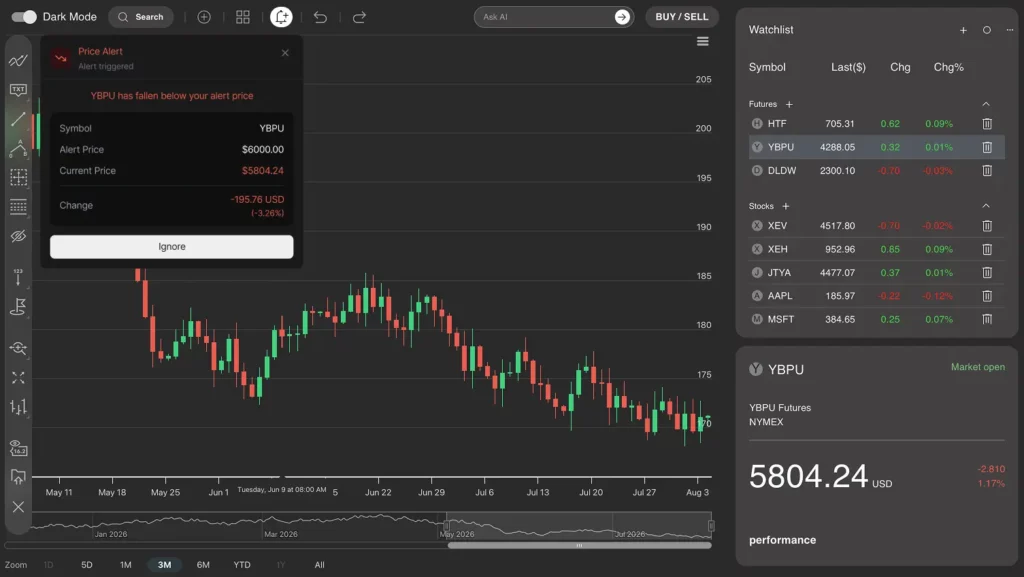

Alerts are notifications generated by the platform to inform users about significant market events, price movements, or changes in indicators. They can range from simple price threshold triggers to complex signals derived from multiple data sources and algorithms. Some alerts are real-time, while others are scheduled or conditional, depending on user preferences.

Traditional alerts often rely on basic rules like “notify when price X crosses level Y,” which can quickly become overwhelming when traders receive dozens or hundreds each day. Without context or prioritization, even the most important alerts can be missed, leading to delayed decisions and increased risk. For a CPO, understanding how alerts are structured, how they reach the user, and how they influence behavior is crucial to designing a product that not only delivers information but also guides users toward better decisions.

Note: Drawing on both our direct work with clients in the investment industry and insights from PwC’s report, which surveyed 300 asset managers, institutional investors, and distributors from 19 countries and 10 territories – this article offers a combined perspective on trading platform alerts and user behavior.

Information Overload & User Fatigue

Challenge

Traders receive dozens to hundreds of alerts per day, spanning price thresholds, volume spikes, order book imbalances, and algorithmic signals. Without contextual prioritization or signal weighting, critical events are lost in the flood of notifications, leading to delayed execution, higher slippage, and increased operational risk during volatile market periods. Margins are being eroded, and costs remain the most visible driver of the squeeze, increasing pressure on platform efficiency.

Solution

Platforms can implement intelligent alert engines that group correlated signals using clustering algorithms or market correlation matrices, assign priority scores based on volatility, volume impact, or strategy relevance, and provide signal rationale leveraging real-time analytics and technical indicators such as RSI, MACD, or VWAP. Interactive dashboards visualize alerts with heatmaps, trend lines, and context layers, enabling faster and more informed decision-making. Traditional cost-cutting has barely made a dent, and diversifying into new asset classes and expanding into new markets adds cost and complexity, making intelligent grouping and prioritization of alerts essential.

Impact on the Business

Reducing information overload increases user trust, decreases alert fatigue, and improves retention and engagement KPIs. Traders can respond to high-priority signals in seconds rather than minutes, giving the platform a measurable edge in execution efficiency and client satisfaction. Confidence in users’ ability to act on alerts is often low, similar to asset managers’ confidence in profitability strategies.

Low Retention & Engagement

Challenge

Traders migrate to competing platforms that provide more actionable alerts and visualized signal relationships, causing churn and reducing average daily active traders (ADAT). Only one in four managers says they’re very confident in their fund’s profitability strategy, reflecting low trust and engagement.

Solution

Alerts should be tailored to trader segments, combining simple triggers for beginners with multi-factor scoring and historical backtesting for professionals. Platforms can visualize relationships between signals, showing dependencies across markets, assets, or instruments, helping users interpret complex data without feeling overwhelmed. Providing context along with actionable recommendations ensures traders remain engaged and confident in their decisions.

Impact on the Business

Improved retention, higher time on platform (ToP), and increased customer lifetime value (CLV). Personalized alerts drive behavioral stickiness, enabling platform growth without higher user acquisition costs.

Lack of Product Differentiation

Challenge

Many trading platforms rely on standard charting tools and basic notification rules, making differentiation difficult. Fee competition is relentless, and intensifying competition is placing even the standout margins under pressure, emphasizing the need for intelligent, context-aware alerts.

Solution

Focusing on signal quality over quantity, platforms can implement context-aware filtering, event-driven triggers, and cross-asset analysis. AI/ML models identify unusual patterns, anomalies, or liquidity gaps, while tiered dashboards with color-coded priorities and actionable recommendations enable fast decision-making. Many firms today still focus on isolated use cases, but the real opportunity lies in developing integrated AI strategies, analogous to integrating AI across alert workflows on the platform.

Impact on the Business

The platform becomes a decision-support system, attracting and retaining users, and strengthening competitive advantage by reducing false positives while improving signal relevance.

Data Integration Challenges

Challenge

Trading data comes from multiple sources: market feeds (Level 1 & 2), historical OHLC data, tick-level volume, and third-party indicators. Inconsistent timestamps, missing values, and feed latency can result in unreliable alerts and poor decisions.

Solution

A unified data pipeline integrates all sources in real time, applying ETL, normalization, and automated reconciliation, ensuring accuracy across exchanges and instruments. Cost-efficient models built around automation and AI remain in the early stages of development and adoption, making robust data integration and automation key for alert reliability.

Impact on the Business

Faster, more reliable investment decisions, increased trust in alerts, reduced execution errors, and improved PnL (Profit and Loss) outcomes.

Interface Complexity for Different User Groups

Challenge

The platform must serve both retail beginners and professional traders without overwhelming either group. Complex dashboards and cluttered alerts reduce signal-to-noise ratio (SNR).

Solution

Design a visual hierarchy for alerts based on priority and relevance, with adaptive dashboards that adjust complexity according to user skill. Customizable alert filters, thresholds, and channels (push, SMS, email, in-platform) help users focus on signals that matter. Asset managers anticipate that by 2030, convergence with wealth management and fintech will have a significant impact on revenue growth, reflecting growing user expectations for comprehensive, intelligent dashboards.

Impact on the Business

Users interpret signals faster, make more profitable decisions, and remain active longer. Engagement metrics such as daily sessions per trader and alert response rates improve.

Pressure to Implement AI in Alerts

Challenge

CPOs face pressure to adopt AI while balancing risk, transparency, and ROI. Poorly implemented models may produce false positives or negatives, eroding user trust.

Solution

AI can filter false alarms, predict market scenarios, and provide context while maintaining human oversight. In a market where margins continue to narrow, intelligence is a prime source of differentiation and profitability, directly adding value to the platform. Demand for AI and data specialists continues to far exceed supply. The challenge isn’t headcount but capability, emphasizing the importance of quality AI implementation and team expertise.

Impact on the Business

AI improves accuracy, decision quality, and trade execution speed. Platforms offering intelligent, context-aware alerts enhance retention and acquisition metrics, building a competitive advantage.

Conclusion – Intelligent Alerts as a Strategic Advantage for CPOs

For Chief Product Officers, the priority is not the quantity of data but the quality of information and how it is presented. Intelligent alerts reduce noise, consolidate related signals, and guide users toward more confident decisions. They transform the platform from a passive tool into a decision-support system that actively improves user experience and operational outcomes.

Over time, these enhancements lead to higher engagement and retention, greater trust in the platform, and a stronger competitive position. Platforms that effectively implement smart, context-aware alerts gain a measurable advantage in both user satisfaction and business growth.

To see how these approaches can be implemented in practice and maximize the value of your trading platform, check Black Label Trading UI, where intelligent alerts are designed to support user decisions, reduce information chaos, and enhance business outcomes.